Excess Inventory: Everything You Should Know to Manage Extra Stock

Extra toppings. Extra vacation days. Extra sleep.

Each one sounds like a dream, right?

But as an ecommerce manager or business owner, there’s one extra “thing” that you likely consider a nightmare: extra stock.

You’re not wrong to feel this way.

Handling excess inventory is one of the costliest inventory management challenges. In 2022, it cost businesses worldwide up to $758.3 billion (yes, that’s a b).

It’s a misuse of warehouse space and capital to store these goods—resources you would rather devote to revenue-generating products.

So how do you clear them out once and, ideally, for all?

That’s what we’ll dive into in this blog post. Read on to learn the key metrics and causes of excess inventory, as well as how to nip it in the bud.

What is Excess Inventory?

Excess inventory arises when a retailer’s on-hand supply exceeds current customer demand. These unsold items risk obsolescence and may eventually lose value over time.

They’re also referred to as dead stock, overstock, or surplus stock.

If your products have a limited shelf-life, it’s even more imperative to monitor them closely. Holding too many goods without accounting for their expiration dates can inevitably lead to financial losses.

What metrics help identify excess inventory?

To make sure your inventory levels don’t go out of hand, you can lean on various inventory management metrics, such as:

- Inventory turnover ratio tracks how fast your inventory sells. A low turnover ratio suggests too much inventory, as it sits on shelves longer than desired. Here’s how you can calculate it.

- Days sales of inventory (DSI) measures the number of days it takes to sell stocks on hand. A high DSI indicates you’re accumulating slow-moving items that contribute to overstocking issues.

- Days of stock left reflect recent sales data. This metric is more sensitive to seasonal variations and tailored to specific business needs.

- Sell-through rate shows the percentage of inventory sold over a specific period. The lower the sell-through rate, the smaller portion of your stock is moving off the shelves, causing surplus inventory.

- Seasonal trends help you anticipate demand fluctuations. Misjudging these trends can result in excess stock, especially with products that have peak and off-peak seasons.

- Customer demand patterns. Analyzing historical sales data and trends helps improve future demand forecasting. If you misread trends or fail to adapt to shifting patterns, you’ll likely end up stockpiling no-longer-wanted items.

Depending on your type of ecommerce business, you’ll need various key metrics to identify surplus stock ahead of time.

For example: Furniture manufacturing company Teak Warehouse uses inventory turnover ratio to see how quickly products sell, and days sales of inventory (DSI) to determine how long items sit on their shelves.

Meanwhile, Kenko Tea, which sells consumable products, relies on a different metric to ensure its products don’t lose freshness over time.

Director Sam Speller explains:

We use days of stock left based on our previous 180 days of sales.

We aim to keep between 90 and 180 days supply on hand at all times. Any higher, we can see our tea quality deteriorate. Any lower, we risk stockouts.

We chose 180 days as sales can fluctuate year to year, and we found that compared to a 12-month average wasn’t accurate enough.

Whichever inventory management KPIs you choose to track, they should reveal which among your practices and processes causes the overstock.

This is key to optimizing inventory management and, in turn, your, stock levels.

10 Major Causes of Excess Inventory

An overstock situation can recur if you don’t know where it originates.

So before we dive into the fixes, let’s first look at the possible reasons your products tend to overstay their welcome in your warehouses.

To show you’re not the only one facing these challenges, I spoke with several ecommerce managers, brand owners, and supply chain professionals who shared their experiences and thoughts on the following problems:

1. Forecasting errors

Unrealistic forecasts distort your optimal purchase volume. If actual sales fall short of demand predictions, ordering excess quantity can result in obsolete inventory.

2. Supply chain disruptions

Natural disasters, political instability, global pandemic, or logistics failures can cause production or delivery delays.

Anything that can halt deliveries tends to have brands placing more orders, which result in excess inventory when the backlog of goods finally reaches the warehouse.

3. Product life cycle changes

New products, market saturation, or tech advancements can render existing products obsolete.

Timing is everything here. If you can’t stay one step ahead or ride the growth wave before introducing a new product or stocking up in time, you’ll be left with excess inventory.

4. Seasonal variations

Certain product demands fluctuate based on the time of year, weather, or holiday events.

If you overestimate the interest in a seasonal product, you’ll be stuck with the carrying costs of holding inventory that stays unsold for a long time.

5. Supplier reliability issues

Inconsistent delivery schedules, quality problems, and supplier constraints may prompt procurement teams to purchase safety stock to prevent stockouts.

But it can also cause overstocks if the delivery stabilizes sooner than expected or demand drops.

6. Economic downturns

Recent research reported that shoppers tend to buy substitute products amid inflation. If your patrons start buying cheaper alternatives, your inventory of higher-priced items may go unsold.

7. Shifting consumer behavior

Products can fly off the shelf one day and collect dust the next. 26% of shoppers stopped buying from a business after a bad experience (minor or significant), showing how fickle consumer behavior can be.

It’s no surprise that retailers that stockpiled during the pandemic panic buying frenzy now have over 30% excess inventory.

8. Poor inventory control

Unintegrated inventory management systems can generate inaccurate data and trigger false low-stock alarms.

You could be OOS on Amazon, but have adequate stocks on your other sales channels. Without visibility, you’ll be tempted to order more.

9. Bulk purchasing and promotions

It’s tempting to buy in bulk, especially when you’re excited about a new product or offering discounted prices and incentives.

If they don’t turn into sales, however, these items will become dead stock (i.e., unsellable or obsolete).

10. Product returns

If you process customer returns but don’t immediately update the system, understated inventory levels can lead to unnecessary replenishments.

You’ll only see the surplus after accounting for the returned items.

How to Manage Excess Inventory Like a Pro

After recognizing the pitfalls your business always falls into, only then can you identify the best solutions.

Here are some of them:

Combine segmentation and forecasting to prevent overstock

Getting to know your products and how they perform allows you to spot slow movers and dead stock.

For this kind of visibility and understanding, you’ll need to segment your products properly and forecast demand more accurately.

Let’s dig deeper into what these two processes entail:

Product segmentation is a way to categorize your inventory based on how well they sell. It’s commonly referred to as ABC analysis and follows the Pareto Principle:

- A is the 20% of your products that can yield up to 80% of revenue.

- B has potential and generates up to 25% of sales.

- C is the inventory you no longer wish to add more to, as they take up space and make little profit.

You don’t have to do exactly what Secret Sauna does because your business likely has different requirements and methods for prioritizing products.

EnVista‘s director of supply chain planning, Seth Burkart explains, that “There are different ways to segment items, but common variables include, velocity, demand stability, profitability, and revenue contribution.”

Demand forecasting, on the other hand, adds more nuance to the picture by showing you which goods your funds should be best used for.

It takes into account market trends, seasonality, customer behavior, and other factors that you don’t really see when categorizing your products based on profitability and impact.

GoodDay Software CEO Kyle Hency explained why considerations, such as seasonal swings, should be considered when purchasing inventory.

Hency, who also founded DTC brand Chubbies, gave this example:

Our end of peak season at Chubbies was 4th of July, and consumer swimwear purchasing slowed down significantly after that period.

As such, we would typically not place huge replenishment orders that could arrive late in the season and potentially result in excess inventory.

Combining both inventory management techniques sharpens inventory accuracy and helps you make data-driven restocking decisions.

In fact, a study proved that doing so can prevent overstocking and stockouts. Even though the research focuses on mechanical engineering, the methodology works in e-retail too.

By simply overlaying 6 months of past consumption data with 5 months of forecast data, the researchers managed to reach up to 92% accuracy.

Leverage technology for better inventory control and increased efficiency

Inventory management without technology is like managing restocks with guesswork. Not the most clever way if you’re looking to reduce stockpile.

Tools like inventory management software have features and integrations (ex: with product lifecycle management software) that can address overstocking causes, such as poor inventory control and dynamic product life cycles.

This gives you the agility to adapt your strategies based on current conditions.

It also provides real-time inventory data across your sales channels, enabling you to make proactive stock replenishment decisions.

But that’s not all. It automates many processes that when done wrong can lead to excessive stockpiling.

This includes demand forecasting, monitoring lead times, setting up the optimal reorder points and accounting for a healthy amount of safety stock.

Plus, monitoring any of the KPIs that can signal surplus inventory accumulation becomes a cakewalk if you have an inventory management system in place.

Founder Devansh Goswami of textile company Ethnic Dreams attested to the effectiveness of using IMS.

We use Zoho Inventory, which has greatly simplified our inventory management.

The software’s comprehensive features have made handling inventory more efficient than ever.

While Teak Warehouse uses NetSuite for inventory management.

CEO Chris Putrimas shared, “Since implementing NetSuite, we’ve seen a significant reduction in carrying costs and improved accuracy in our forecasting, leading to better alignment between inventory and sales.”

Choosing the right inventory management software requires you to look at your business’s tech stack to ensure that it can collect all the inventory data you need in one place.

Author’s Tip

Reminder to pick one that can embrace your multichannel or omnichannel approaches to prevent inventory data diversification that can lead to excess stocks.

Here are 10 top vetted picks (of the 30 we chose), see which one will benefit your ecommerce needs the most:

- Cin7 Core — Best for manufacturers and product sellers

- SkuVault — Best for its detailed restocking recommendations

- Linnworks — Best for multichannel management automation

- MRPeasy — Best for manufacturers

- Helcim — Best for small business inventory + POS in one

- Zoho Inventory — Best for small businesses

- Acumatica — Best for modern UI

- Sage X3 — Best enterprise resource tracking (ERP) package

- Cin7 Omni — Best for advanced multichannel order management

- ShipBob — Best end-to-end inventory & fulfillment

Aside from reaping the benefits of using inventory management software, tap into other innovative technologies such as barcodes and RFID to make inventory tracking and counts more efficient.

Use the right inventory management technique

The inventory management techniques you employ will vary based on your products, business size, budget, and supply chain requirements.

But if you’re constantly getting bogged down by inventory glut, give just-in-time inventory management a try.

JIT centers on receiving and stocking inventory near the point of sale in order to reduce warehouse costs and eliminate wasted products.

Jeff Wolpov, E2E supply chain solution Ryder’s senior vice president for ecommerce, shared some advice to make this strategy work for you:

Having a well-coordinated supply chain and strong relationships with suppliers, ecommerce businesses can receive products in a timely manner, reducing the need for excessive stockpiling.

He also recommended dropshipping as a means to prevent overstock build-up: “With dropshipping, products are shipped directly from the supplier to the customer, bypassing the need for warehousing and reducing the risk of excess inventory.”

Further reading recommendation

Along with proper inventory management techniques, you can achieve lean inventory by following these best practices.

Reduce excess inventory by implementing a perpetual inventory system that keeps your stock levels balanced and accurate.

Implement strategic return prevention strategies

Product returns cause a lot of problems for your business. They’re costly, amounting to approximately 17% of the prime cost.

They happen quite often, especially for ecommerce brands—the average return rate for online purchases is 17.6%. That’s nearly 1 in every 6 purchases going back to your warehouse.

Therefore, it’s safe to say that they lead to excess inventory.

To lessen stock surplus generated by product returns, put prevention strategies in place, namely:

- Improving customer service. Train your staff and invest in ecommerce customer service software.

- Picking the right inventory management software. Tools like Cin7 Corehelps businesses track return inventory data.

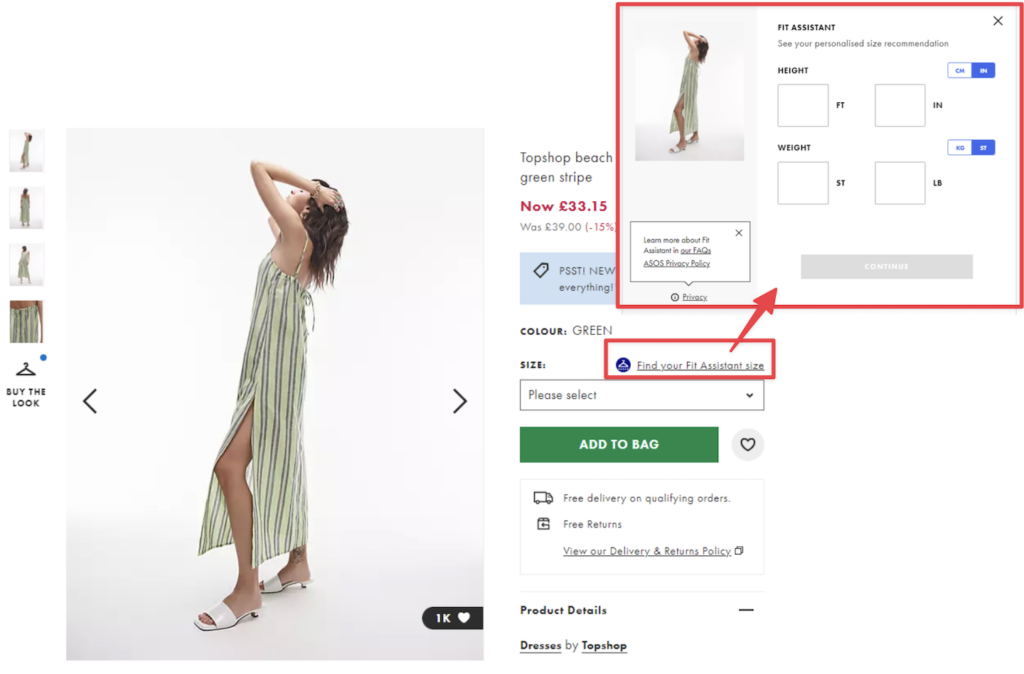

- Providing accurate product descriptions. 49% of surveyed shoppersreturned an item because it didn’t match the description provided. Be as precise and transparent as you can. ASOS has a “Fit Assistant” to ensure shoppers don’t get confused by sizing information:

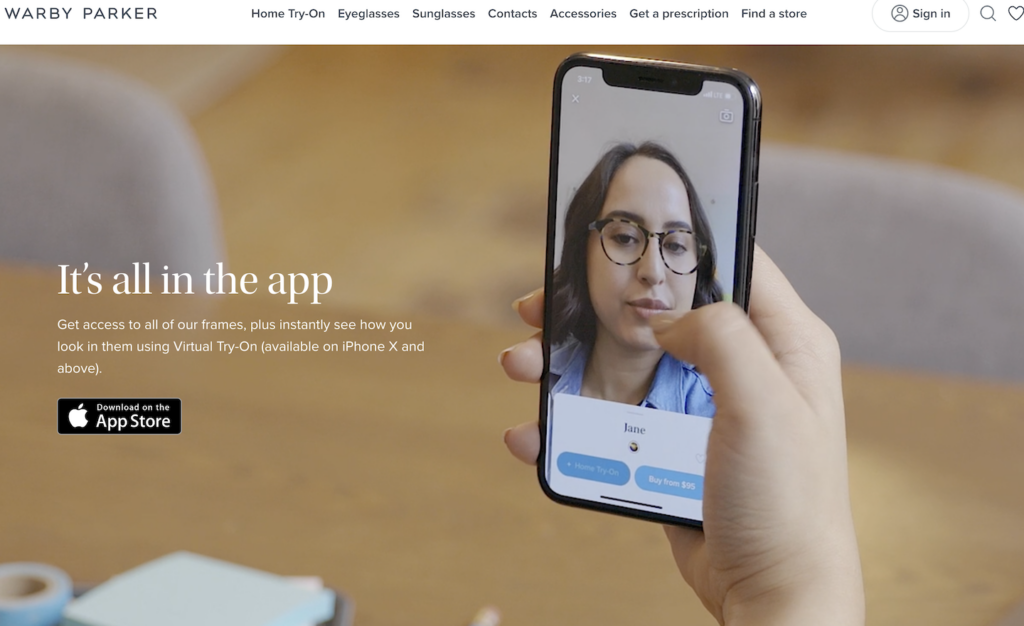

- Giving online shoppers a chance to virtually experience your product. One of the most successful digitally native brands, Warby Parker, leverages augmented reality to let online shoppers try on eyewear frames before making a purchase.

Reduce inventory while turning surplus stock into profits

When you find yourself in the unfortunate position of having ordered or manufactured too much inventory, you may be in a pinch, but you’re not stuck.

Wolpov echoes the sentiment, sharing that: “Excess inventory is not automatically dead inventory. If you do end up with excess, there are certainly ways it can lead to positive outcomes.”

The best solution? Offering promotions. It’s a fantastic way to lessen carrying costs and make some profit margins.

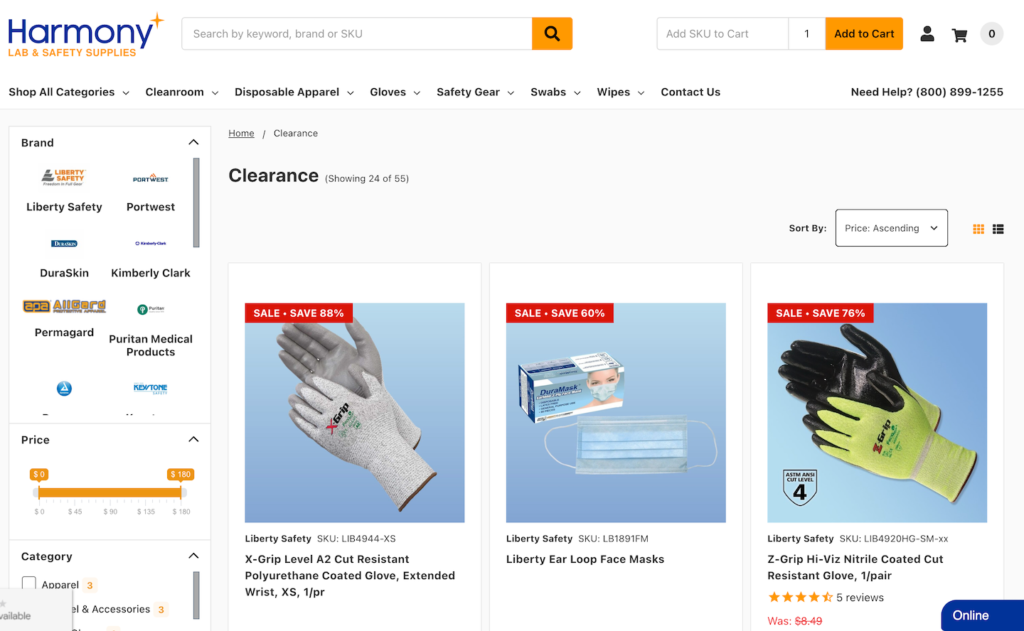

Ecommerce businesses like Or & Zon and Harmony Business Supplies have benefited from doing this.

Guillaume Drew, Or & Zon founder, shared:

We’ve found success in excess inventory management through timely sales promotions, bundling products, and collaboration with interior designers and hospitality businesses to widen our customer base.

Sean Clough of Harmony Business Supplies stated they employed similar strategies, including flash and clearance sales, as well as cross-promotions.

This helped the company cut down excess inventory by 30% in 2023.

Source: Harmony clearance and overstock page

You can also find buy-and-sell groups to unload your extra inventory to up-and-coming businesses.

According to Jessica Principe of subscription ecommerce brand All Girl Shave Club, this allowed her to transfer the savings from bulk purchases to new brands while building relationships with them at the same time.

Author’s Tip

Aside from discounts and product bundles, you can offer surplus inventory as a freebie to customers who reach a certain purchase volume.

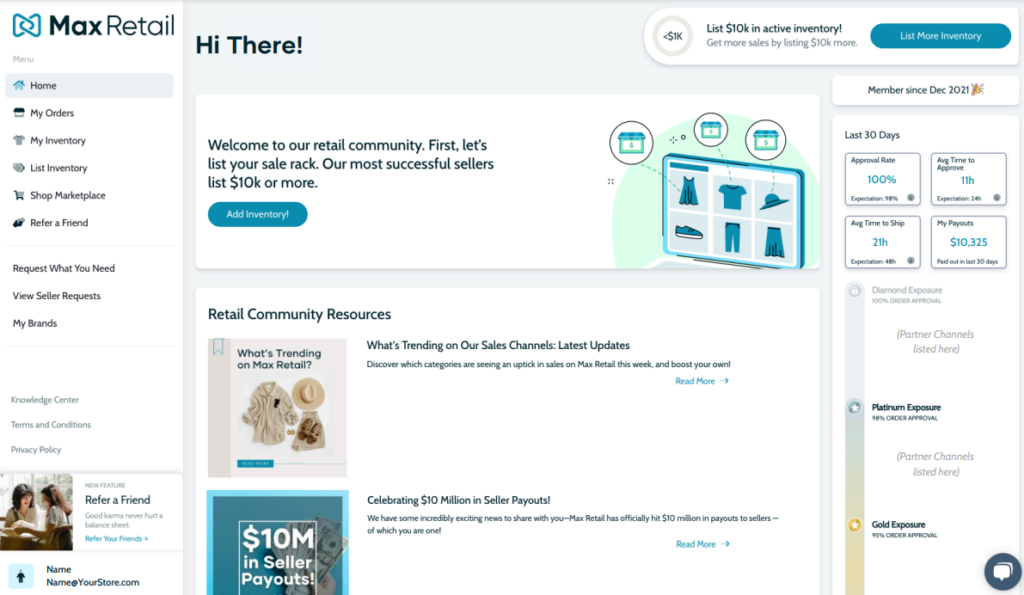

If these strategies don’t deplete your redundant stocks completely, online marketplaces like Max Retail exist to promote your unsold goods to a vast network of online and offline retailers.

CEO Melodie van der Baan revealed that the platform assists retailers and brands to sell aging inventory without compromising confidentiality across 18 North American, Latin American, and Asian markets.

Max Retail Dashboard

Last but not least, give to charity.

An in-kind donation is a low-cost way to support the nonprofit sector and meet some of your corporate responsibility goals. Plus, it can also help improve your bottom line.

According to Gary Smith of National Association for the Exchange of Industrial Resources (NAEIR), the US’ largest gifts-in-kind organization, C Corporations that donate their inventory to a qualified nonprofit benefit more than writing it off as a tax deduction.

He explained:

Deductions are equal to the cost of the inventory donated, plus half the difference between the cost and fair market-selling price, not to exceed twice the cost.

For example, if your product costs $10, and you sell it in store for $30, the difference is $20.

Half of $20 is $10. So, $10 (product cost) plus $10 (half the difference) equals a $20 deduction. As $20 does not exceed twice the product cost, it is an allowable deduction. It’s a win-win.

Companies that aren’t C Corps can benefit as well. The public good will and favorable PR that can accrue from your generosity are additional bonuses of in-kind donation.

Through this strategy, brands like Teak Warehouse have freed up warehouse space, while aligning with their values of sustainability and social responsibility.

Pros and Cons of Holding Excess Inventory

Is holding excess inventory a good idea for your business? Let’s compare the pros and cons:

| Pros | Cons |

| Avoiding stockouts: Ensures 100% demand fulfillment without stockouts, enhancing customer satisfaction. | Increased storage costs: Extra storage space means higher warehouse and utility costs. |

| Leveraging bulk pricing: Suppliers sometimes offer discounts or freight savings for bulk orders. | Cash flow problems: Funds tied up in unsold inventory limit liquidity. |

| Buffer against supply chain disruptions: Provides a safety net to guarantee business continuity during supplier delays or shortages. | Risk of obsolescence: Fast-moving or short-lifecycle SKUs can become obsolete and cause financial losses. |

| Operational inefficiencies: Cluttered storage spaces can stall order fulfillment and increase the risk of product damage. |

Claudia Ivette Aguilera, a supply chain director, favors increasing inventory investment when you’re struggling to keep up with demand.

This makes sense when you’re always met with stockouts.

Barry Bradley doubled down on this, pointing out that short-term excess inventory can be beneficial for planned promotions or peak demand periods.

However, he doesn’t think it should be deemed excess because it’s strategically anticipated and managed.

“Real excess” inventory has real downsides. Bradley went on to explain:

There are many downsides to excess inventory including high storage and stocking fees, elevated shipping costs, potential for expired or wasted products and the potential for markdowns on unsold goods.

All these downsides eat into the margin of the product and can also divert products from other locations where there may be out-of-stocks.

Sarah Scudder, Voice of Supply Chain host, seemingly agree with this.

In a tweet, she shared “Yes, it [sic. holding excess inventory] helps you hedge for risk. But how much inventory you keep, and how it’s optimized, plays a big role in how a business fares financially.”

Ultimately, only you will know your customers and how fast your inventory moves. It’s up to you to weigh how much surplus stock you can hold without incurring losses.

Final Thoughts

If you’re currently dealing with the stock surplus, there are many ways to offload it, like offering promotions and giving to charity.

Moving forward, however, I highly recommend directing your efforts toward reducing the chances of encountering it.

You can do this by optimizing your inventory management process using the right IMS.

This technology alleviates the main causes of overstocking in so many ways—most notably, giving you better inventory control, more accurate demand forecasts, and increased supply chain visibility.

You might also be interested in reading:

- Our top tips for improving inventory management in general as well as for ecommerce inventory management.

- Discovering the best ecommerce inventory management software.

- The best free inventory management tools—suitable for small businesses and startups.

In ecommerce, things move fast—and you have to keep up. Subscribe to our newsletter with the latest insights for ecommerce managers from the best in the business.

Excess Inventory FAQs

We’ve covered the causes and the fixes of having excess inventory, but these questions can shed more light on them.

What’s the best way to prevent excess inventory in the future?

Focus on accurate forecasts and invest in real-time inventory systems to monitor and modify replenishments based on current data.

It’s far easier to order what you require and adjust as demand changes than to deal with excess stocks later.

What are the signs that indicate it’s time to liquidate excess inventory?

If you notice these signs, it may be time to consider liquidation strategies to free up space and capital.

- Items in storage for months or years with no sales activity

- Perishable goods nearing their expiration dates

- Out-of-season items that are unlikely to sell

- Inventory levels far exceeding typical demand

- Limited warehouse space due to excessive stock

What are some common mistakes to avoid when managing excess inventory?

Handling surplus doesn’t only mean getting rid of items that have piled on your shelves.

Retailers often overlook mismatched data and miscommunication between departments. If your ecommerce shop displays low stock while your warehouse is full, it might trigger unnecessary orders.

Consider investing in advanced inventory management software and ERP systems to synchronize inventory data across all channels. Then, schedule periodic audit checks to compare physical stock against recorded data for accurate monitoring.